38+ How much can a first time buyer borrow

The quick answer is around 4 to 55 times your income. Ad Mortgage Rates Have Been on the Decline.

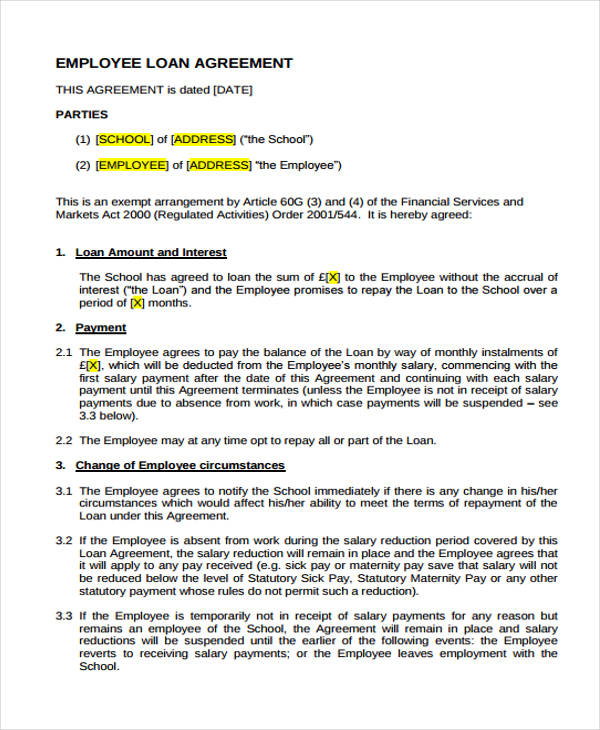

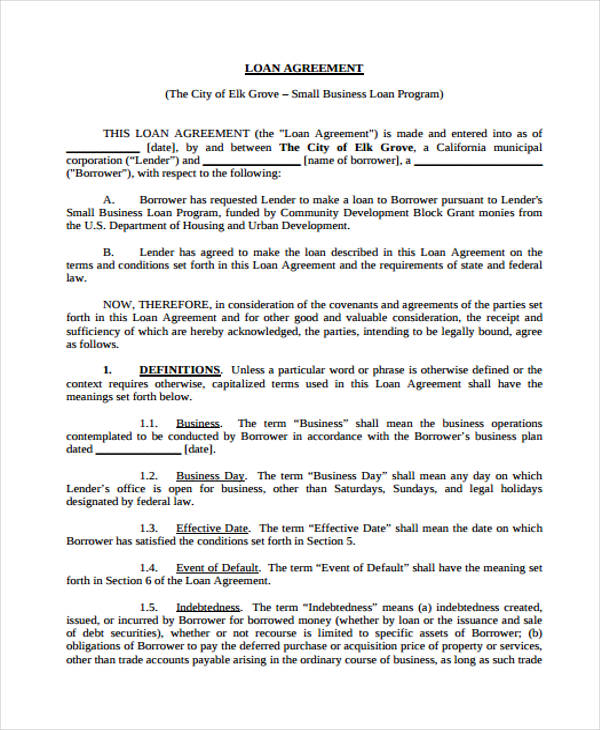

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Your ability to borrow money will be determined by.

. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. The first step in buying a house is determining your budget. Theres no first-time buyer relief in Wales but if youre buying your first property in Scotland your zero-tax threshold will be raised from 145000 to 175000.

Simply put a first time buyer is a person who has never taken out a mortgage for a property before. Ad Were Americas Largest Mortgage Lender. Ad Chat Online With One Of Our Reps From The Comfort Of Your Own Home.

Faster Simpler More Affordable Mortgages. So for example if youre. When looking to purchase a property it is an exciting time with a lot to think about.

You must be buying. Most commonly lenders allow you to lend between 4 and 45 times your annual salary some will offer 5 times some 6 and in very very rare cases 7 times the amount. Compare Mortgage Options Calculate Payments.

In the case of a joint application both parties must be first time buyers to be eligible. Lock Your Mortgage Rate Today. In the past mortgage lenders were willing to offer 100 mortgages to first-time buyers but since the economic crisis lenders have tightened up and this risky practice was one of the first.

Understand how mortgages work and get an official mortgage estimate. Most people have a good idea of what their ideal home will look like the area and type of property they. Borrow between 4 5 x your gross annual income after deducting your existing credit commitments If you are debt free and have a strong credit score some affordability.

Mortgage lenders routinely use it to assess home loan applicants. Fast VA Loan Preapproval. Get Your VA Loan.

Under this scheme you can borrow 20 of the. Available to first-time buyers and existing homeowners who want to buy a new build house. Check Your Eligibility for a Low Down Payment FHA Loan.

Lenders can offer mortgages of more than 45 times someones earnings in no more than 15 of new mortgages. Get Preapproved You May Save On Your Rate. The Best Lenders for First Time Loans.

Today things are different. If you have a healthy and steady cash flow you can expect the amount to be twice as much as your income. VA Loan Expertise Personal Service.

Step 2 Calculate how much you can borrow. Trusted VA Loan Lender of 300000 Veterans Nationwide. Ad First Time Home Buyers.

For example if your income is 300000 all reputable mortgage. Savings Include Low Down Payment. Take the First Step Towards Your Dream Home See If You Qualify.

Basically the LVR is an expression of how much you plan to borrow versus the current value of the home. Contact a Loan Specialist. Ad Compare Lowest Mortgage Loan Rates Today in 2022.

However as with all things in life its not quite that simple. See How Much You Can Save. No Monthly or Annual Fees.

First-time Buyer Guide. Fill in the entry fields and click on the View Report button to see a. Ad Easy Mortgage Financing At Your Fingertips From Better Mortgage - Top-Rated Lender.

Tips For First Time Home Buyers. Several factors help the. When you are ready to take the next step on your home.

Request A Personalized Home Quote That Fits Your Needs. Ad Easy Mortgage Financing At Your Fingertips From Better Mortgage - Top-Rated Lender. Top-Rated Mortgage Loans 2022.

How much can I borrow calculator. The Bank of England introduced. How much can a first time buyer borrow Jumat 16 September 2022 Edit.

That means for a first-time home buyer down. The purchase price must be no more than 600000. Faster Simpler More Affordable Mortgages.

Top Rated Mortgage Advice. First time buyers can take out a mortgage of up to 90 of the purchase. It will set your property budget so that you can start looking at homes.

How much can a First Time Buyer borrow. How much can I borrow as a first-time buyer. Finding out how much you could borrow is a vital step towards owning a home.

Apply Now With Rocket Mortgage. Most home buyers use a combination of mortgage facilities and savings or help to buy schemes to buy their new home. 455 31 votes So realistically most first-time home buyers need at least 3 down for a conventional loan or 35 for an FHA loan.

This mortgage calculator will show how much you can afford. According to market research the average loan amount for first-time buyers is 176693. How much can I borrow as a first-time buyer.

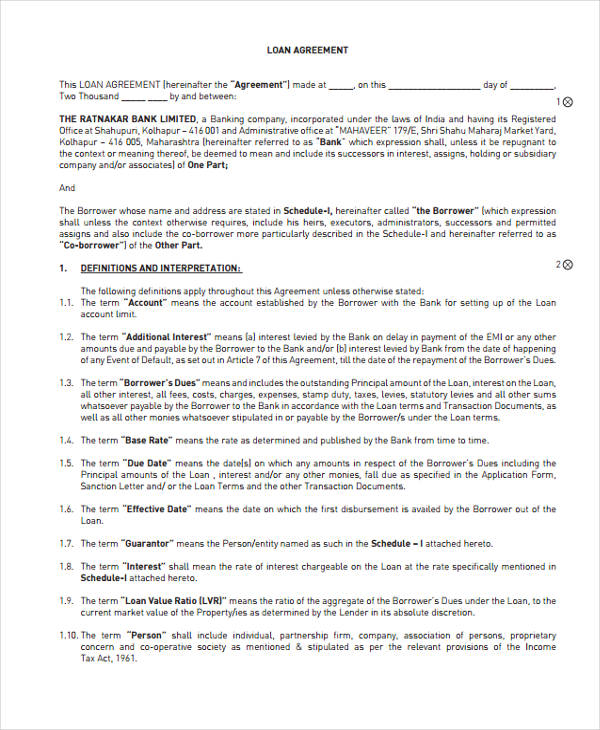

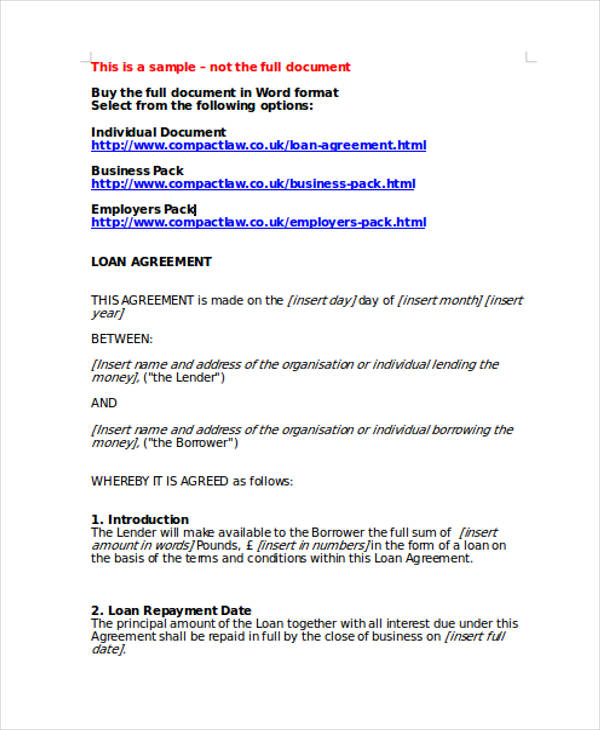

Free 65 Loan Agreement Form Example In Pdf Ms Word

Free 65 Loan Agreement Form Example In Pdf Ms Word

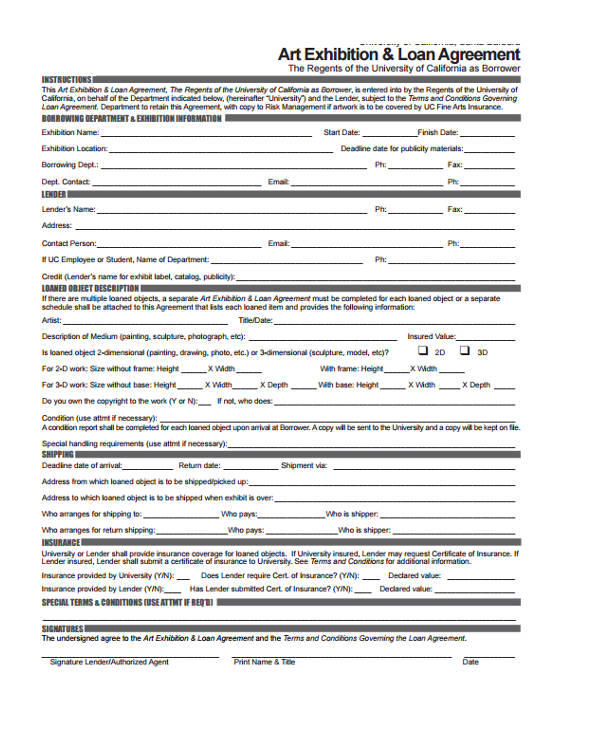

Free 56 Loan Agreement Forms In Pdf Ms Word

Quarto Powerpoint Template By Descarteshouston Graphicriver

Free 56 Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 56 Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 56 Loan Agreement Forms In Pdf Ms Word

Borrow Money Contract Template Beautiful Sample Lending Contract Sample Contract Template For Contract Template Agreement Contract

Free 65 Loan Agreement Form Example In Pdf Ms Word

Free 65 Loan Agreement Form Example In Pdf Ms Word

38 In Word Form Form Udlvirtual Edu Pe

Free 65 Loan Agreement Form Example In Pdf Ms Word

Free 65 Loan Agreement Form Example In Pdf Ms Word

Free 65 Loan Agreement Form Example In Pdf Ms Word